Is your Pipeline Drier Than a Stack of Old Paper Receipts? Let’s Fix That. Tired of hearing “I’m happy with my current processor” or getting ghosted after you send a proposal? Let’s turn those frustrating moments into fuel. Building rock-solid relationships with merchants is the only way to build a real, long-term book of business and get that keep our residual income flowing.

In this business, it’s not just about all that we offer; it’s about selling trust. Here are ten proven strategies to break out of any slump, cultivate connections that last, and get you back to closing deals.

From the Home Office in Monkey’s Eyebrow, Kentucky, Here are the Top 10 Ways to Get Out of a Sales Slump:

10. Farm Your Own Backyard (Leverage Existing Merchants) Your current book of business is a gold mine. These merchants already know you and trust you. Are they using a clunky old terminal? It’s time to talk about a modern POS system. Do they need a gift card program for the holidays? You’re their go-to. Deepen these relationships to protect your residuals and uncover new revenue.

9. Give to Get (Share Referrals) We all love getting a hot lead dropped in our lap, but are you giving them out? When you refer a great CPA or web designer to one of your merchants, you become more than a processor—you become a valuable partner. It energizes your network and makes it a whole lot easier to ask for referrals in return.

8. Re-engage the Ghosts of Merchants Past Remember that restaurant that left you a year ago for a “smokin’ deal”? It’s time for a friendly check-in. That deal probably came with hidden fees and non-existent customer service. Reach out, see how they’re doing. A simple call can expose their new provider’s weaknesses and open the door to win them back.

7. Practice Active Gratitude Your merchants get pitched by competitors every single day. Show them you appreciate their business. Instead of another sales email, pick up the phone and say, “Hey, just calling to say thanks for being a great client. How did that busy weekend go?” A little gratitude goes a long way in preventing attrition. Start your day by naming five merchants you’re thankful for—it will change your entire perspective.

6. Set Goals You Can Actually Crush Aiming to add $5 million in processing volume is great, but it’s a marathon. Focus on the daily sprint. Set smaller, achievable goals like: “Get 3 new statements to analyze today” or “Make 10 more cold calls than yesterday.” Success builds on success; small wins create momentum.

5. Build Your Own Board of Directors (A Mastermind Group) Connect with a few other sharp B2B salespeople (think payroll, insurance, linen services). Meet regularly to trade leads, share what’s working, and hold each other accountable. You’ll get fresh perspectives and a support system that understands the grind.

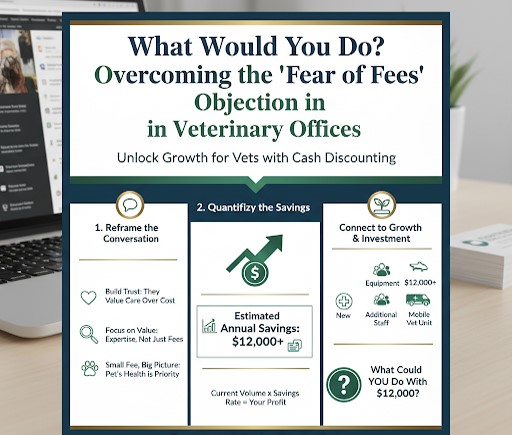

4. Solve Their Problems, Not Yours Stop selling processing and start selling solutions. Zig Ziglar was right: “You will get all you want in life if you help enough other people get what they want.” Does your retail client want to compete with online giants? Talk e-commerce gateways. Does the auto shop need to reduce chargebacks? Teach them best practices. Help them win, and you will win.

3. Own Your Morning If you don’t control your day, your day will control you. The top reps in this industry don’t just roll into the day. They’re up early, planning their route, prepping their pitches, and getting their mindset right before the chaos of emails and service calls begins.

2. Celebrate Every Single Win Just closed a small deli that will only process $15k a month? Awesome! Celebrate it. Don’t fall into the trap of comparing your small win to the monster deal you see someone else post on LinkedIn. Comparison is the thief of joy. Focus on your progress and give yourself credit for every signed merchant agreement.

And the #1 Way to Get Out of a Sales Slump is…

1. Build a Bulletproof Mindset A sales slump can be caused by the economy, a new competitor, or just a bad week. But the only thing that can keep you in a slump is your mindset. By actively working on these ten strategies, you aren’t just changing your actions; you’re forging a success-oriented mindset that sees opportunity where others see obstacles.

Remember: Motivation isn’t a one-time event; it’s a daily commitment to the process. Now go make it happen.

Have a Great Weekend,

David