Hey fellow merchant services warriors! Easter’s hopping our way, and while we’re all focused on closing deals and providing top-notch service, it’s always good to refresh our knowledge and understand the holiday’s nuances. This isn’t just about cultural awareness; it’s about connecting with our merchants on a deeper level and understanding the seasonal trends that impact their businesses (and our commissions!).

So, let’s dive into 10 Easter facts that might surprise even seasoned merchant services pros:

10. Easter’s Date: A Lunar Puzzle:

We all know Easter moves, but do you know why? It’s calculated based on the first Sunday after the first full moon following the vernal equinox. This can shift the holiday by over a month! Understanding this helps us anticipate seasonal spikes and better advise merchants on promotional planning.

9. The Egg’s Ancient Symbolism:

While we see eggs as an Easter staple, their symbolism predates Christianity. They represent rebirth and new life, connecting to ancient spring festivals. This highlights how traditions blend and evolve, a point we can use to connect with diverse merchants.

8. The Easter Bunny: A Marketing Goldmine:

The Easter Bunny’s origins are a bit fuzzy, but its impact is crystal clear. It’s a powerful symbol for retailers, driving sales of candy, toys, and decorations. Understanding its appeal helps us tailor our sales pitches and highlight the potential for seasonal promotions.

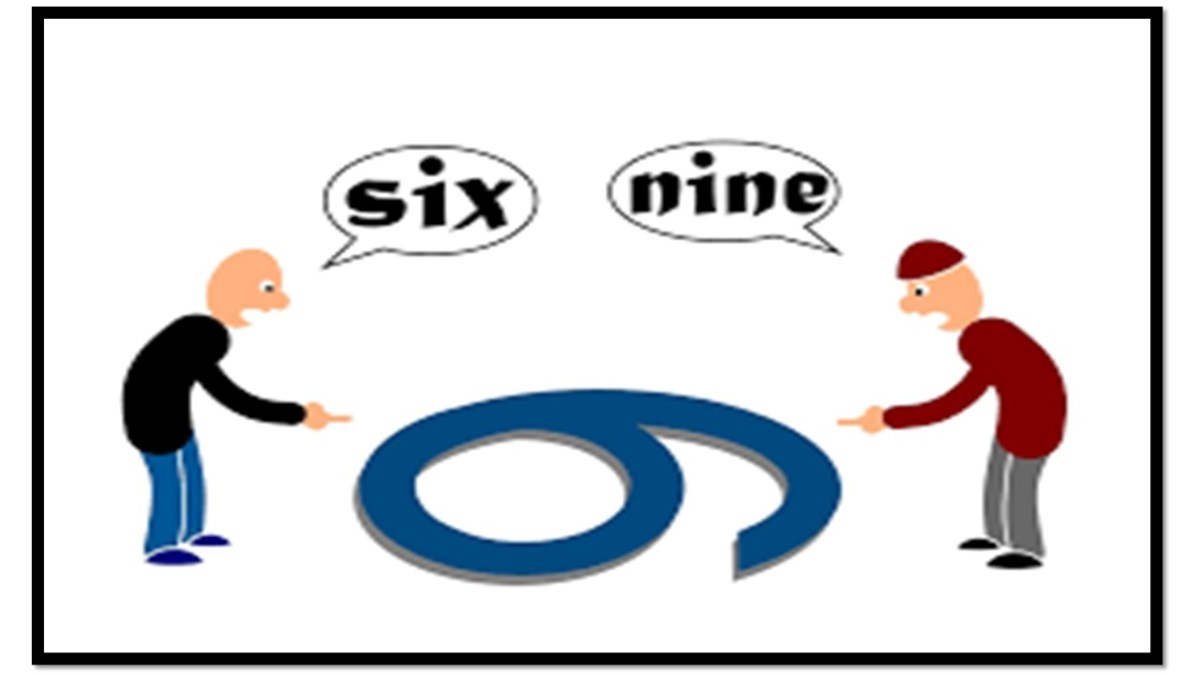

7. “Easter” & the Spring Goddess:

The name “Easter” might derive from Ēostre, an Anglo-Saxon goddess of spring. This connection to renewal resonates with many, even those who aren’t religiously observant. It’s a reminder that holidays have diverse meanings.

6. Hot Cross Buns: A Historical Treat:

These spiced buns have a long history and were traditionally eaten on Good Friday. Understanding their cultural significance allows us to engage in more meaningful conversations with merchants in the food service industry.

5. Easter Parades: A Display of Community & Commerce:

Easter parades, particularly in major cities, showcase new spring fashions and celebrate community. This translates to increased foot traffic for retail businesses, making it a prime time to pitch point-of-sale solutions.

4. The White House Easter Egg Roll: A National Tradition:

This event highlights Easter’s cultural importance and its ability to bring people together. It’s a reminder that holidays are about more than just sales; they’re about shared experiences.

3. Easter Lilies: Symbols of Hope & Beauty:

These flowers are a staple of Easter celebrations, representing purity and hope. For florists and gift shops, this translates to increased sales. Knowing the symbolism can help us connect with merchants in these sectors.

2. Lent’s Impact on Consumer Behavior:

Lent, the 40-day period leading up to Easter, can influence consumer spending. Some people abstain from certain goods or services, while others prepare for Easter celebrations. Understanding this helps us anticipate fluctuations in merchant transactions.

And the #1 Top 10 way to Level Up Your Easter Knowledge: 10 Things You Might Not Know is …

1. Easter’s Profound Spiritual Significance and its Economic Impact:

“At its core, Easter is the celebration of the resurrection of Jesus Christ, the cornerstone of Christian faith. It symbolizes the triumph of life over death, hope over despair, and new beginnings. This spiritual renewal resonates deeply with many, influencing their actions and spending habits during this time. This translates into the economic impact that Easter has. From increased spending on family meals and gifts, to travel and celebratory items. for business owners, this means increased sales. But as a person, it means that many of our clients are experiencing a time of deep spiritual reflection. So, having patience and understanding, and providing great service, is more important than ever. And of course, make sure their processing needs are ready for the influx of customers! (Hint: That’s where we come in!)”

Have a safe Easter Weekend,

David