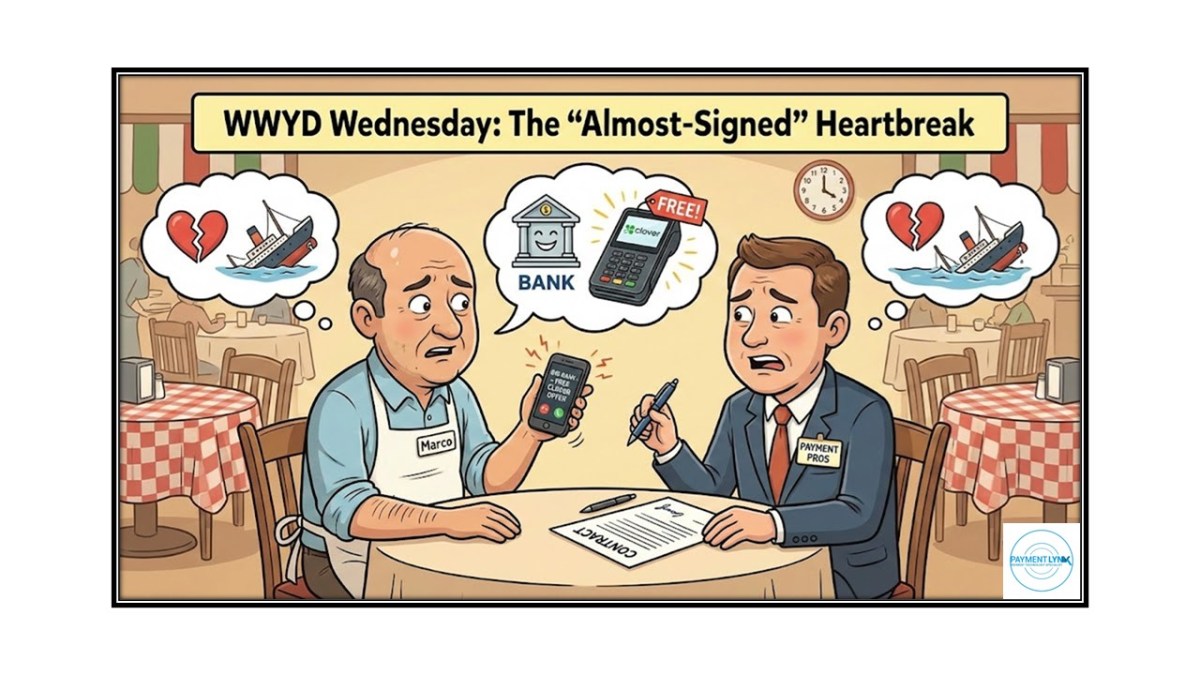

We’ve all been there. It’s 4:00 PM on a Tuesday. You’ve visited that local Italian spot three times. You know the owner’s name (it’s Marco), you know his daughter just started college, and you finally convinced him that his current processor is eating his margins alive with hidden “PCI Non-Compliance” fees.

The contract is on the table. You’ve got your favorite pen ready. Then, Marco’s phone buzzes.

He looks at it, frowns, and looks back at you. “Listen, I really like you. You’ve been great. But my bank just called. They said if I stay with them, they’ll cut my rate by another 10 basis points and throw in a brand-new Clover Station for free. I want to work with you, but I can’t leave money on the table. What should I do?”

Your heart sinks. You’ve put in the hours, and now a “free” piece of hardware and a tiny rate cut are about to blow up the deal.

The Reality Check

In merchant services, we aren’t just selling a terminal; we’re selling advocacy. The bank sees Marco as an account number. You see him as a partner. But when a merchant is looking at a “free” $1,200 piece of equipment, logic often goes out the window.

So, What Would You Do?

Here are three ways to handle this. Which one matches your style?

Option A: The “Math” Defense You pull out the calculator. You show him that 10 basis points on his $30k volume is only $30 a month. Then, you show him the “Equipment Lease” or “Service Agreement” fine print in the bank’s offer. Is that “free” Clover actually free, or is there a 48-month non-cancelable contract hiding in the shadows?

Option B: The “Personal Service” Pivot You look him in the eye and say, “Marco, when that Clover stops working at 7:00 PM on a Friday night during your dinner rush, who are you going to call? A bank 1-800 number with a 40-minute hold time, or my cell phone? I’m the guy who drives over here with a backup unit in my trunk.”

Option C: The “Value-Add” Sweetener You realize you can’t beat “free,” so you change the game. You offer to integrate his online ordering or help him set up a loyalty program that will bring in 20% more customers. You move the conversation from “saving $30” to “making $3,000.”

What’s Your Move?

This is the “make or break” moment that defines a top producer. Do you walk away, drop your price even lower, or stand your ground on the value of your relationship?

Drop a comment below and let me know: How would you save this deal?

Happy Selling,

David