Let’s be honest. If you tell a stranger at a cocktail party that you sell merchant services, you get one of two reactions:

- Their eyes glaze over like a Krispy Kreme donut.

- They immediately clutch their wallet and whisper, “Are you the reason my AMEX fees are so high?”

We are the unsung heroes of commerce. We are the people who know that “Interchange Plus” isn’t a highway exit. But the life of a payment processor rep is an emotional rollercoaster.

Here are the five stages we all go through every single month.

1. The “Wolf of Wall Street” Morning

You wake up. You’ve had your coffee. You put on your headset. You are pumped. You are going to close 2-3 deals today, a hat trick. You are going to save local businesses thousands of dollars!

You look at your lead list and think, “I am not just a salesperson. I am a liberator of hidden fees. I am the residuals king or queen!”

2. The Gatekeeper Gauntlet

Then, you make the first call. “Hi there! Is the owner around? I have a quick question about—” Gatekeeper (The 19-year-old host named Clyde): “He’s not here. He’s never here. He actually doesn’t exist. He is a concept. Also, he said to tell you we love paying 4.5% flat rate.” [Click]

You stare at the phone. You respect Clyde’s lying ability, but it hurts.

3. The “Statement Analysis” Forensics

Finally, you get a live one! A business owner agrees to send you a statement. You open the PDF, ready to find the savings.

But this isn’t a statement. It’s a hieroglyphic puzzle designed by a sadistic mathematician. There are “Non-Qualified Surcharges,” “Mid-Qualified Tiers,” and a line item just labeled “BECAUSE WE CAN – $49.95.”

You spend two hours decoding it, only to realize the previous rep locked them into a 48-month lease on a terminal that is technically a calculator from 1998 glued to a phone line.

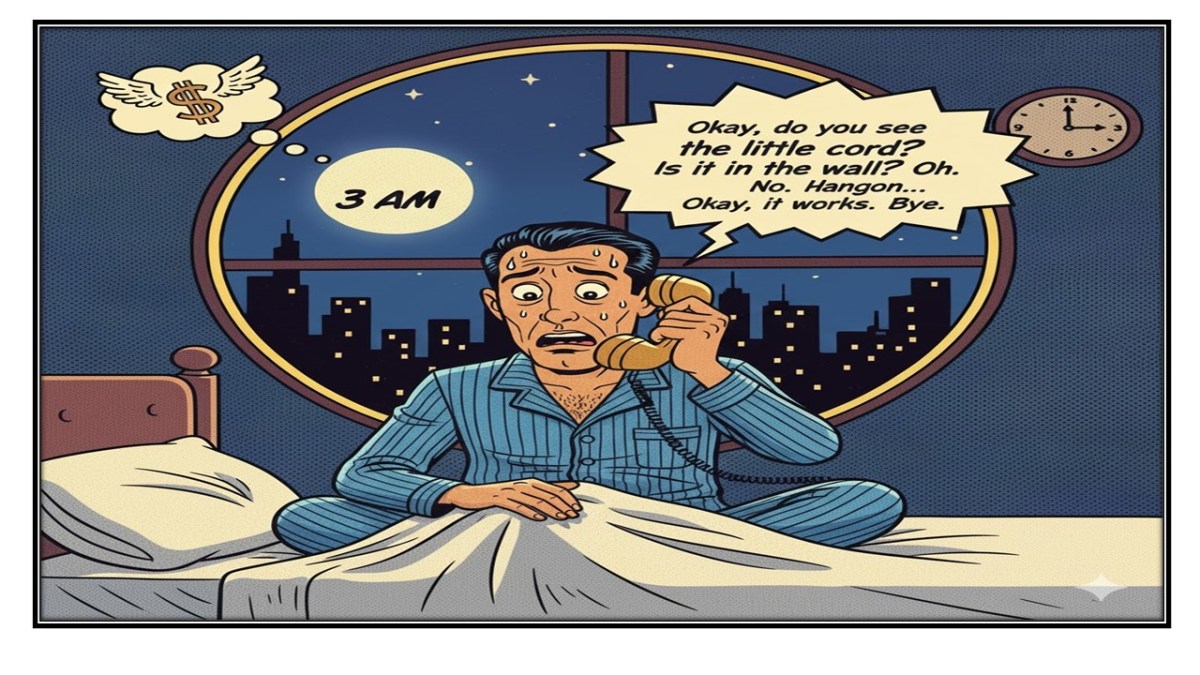

4. The “It’s Not Plugged In” Tech Support

You closed the deal! The equipment arrived! And then your phone rings at 7:00 PM on a Friday.

The machine is broken. I’m losing millions. Fix it.

“Okay, do you see the little cord? Is it in the wall?”

“Oh. No. Hang on… Okay, it works. Bye.”

5. The Residual Nirvana

Then comes the 20th of the month. The deposit hits. The portfolio grew. You see that passive income tick up just enough to cover our car payment.

Suddenly, the hang-ups, the PCI compliance nightmares, and the demanding pain of clients fade away. You smile. You love this job. You are a payments god.

Time to do it all again. Please see the first Jingle of the 2025 season.

The Merchant Services Jingle

(To the tune of “It’s Beginning to Look a Lot Like Christmas”)

“It’s Beginning to Look Like Residuals”

It’s beginning to look like residuals, Everywhere I go, There’s a terminal in the store, By the entrance and the door, And the interchange is getting mighty low!

It’s beginning to look like residuals, Leads are on the floor, But the prettiest sight to see, Is the lack of a monthly fee, On your own front door!

A pair of Sky Tab stations is a POS that’s blazing, Is the wish of Barney and Ben, Devices that talk and a Wi-Fi that walks, And a batch that closes out by ten!

And Mom and Dad can hardly wait, To see that brand new processing rate!

It’s beginning to look like residuals, Everywhere I go, There’s a merchant who wants to switch, Without a single glitch, With the cash flow with dual pricing the money flows, let it flow, let it flow!

And that, my friends, is the cycle. From “Residuals Royalty” back to “Gatekeeper Guy,” we start again each and every day. We know the pain, the triumph, and the soul-crushing terror of a high-risk application.

But seriously, who else gets paid to argue about basis points with a donut shop owner? We’re truly blessed.

Now if you’ll excuse me, I think I just got a notification that a terminal is unplugged at the hibachi restaurant . Wish me luck.

Happy Selling,

David