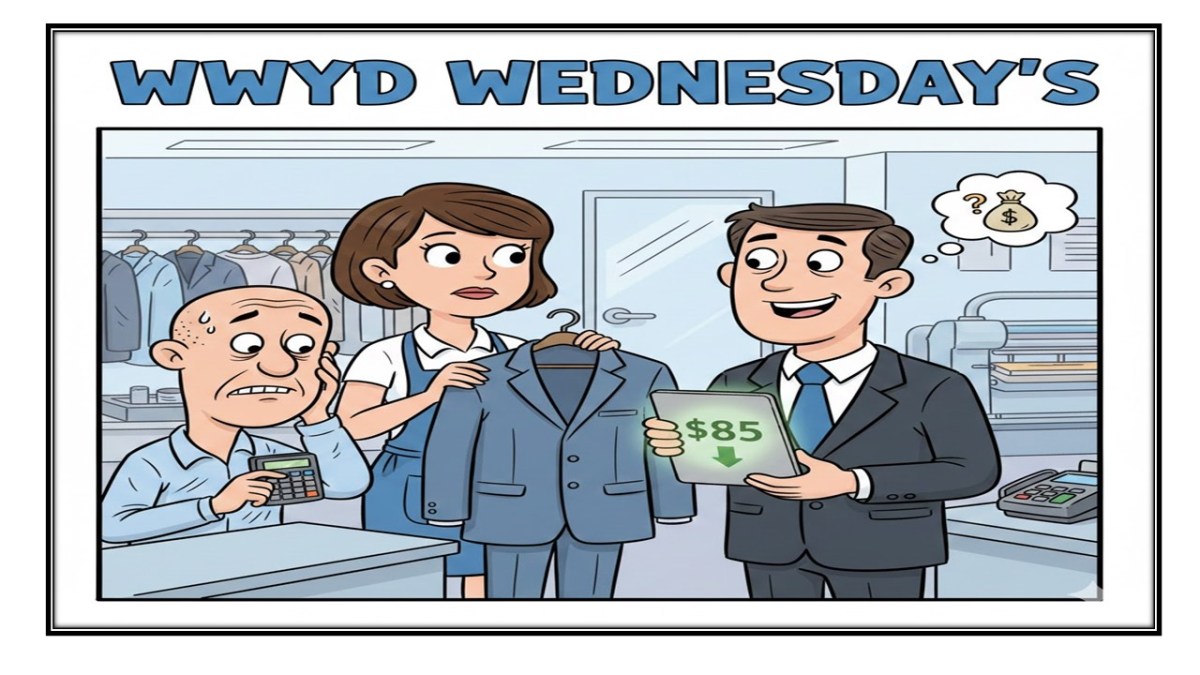

This week on WWYD Wednesday, we’re diving into a scenario that hits close to home for anyone in the merchant services industry: the tough choice between preserving a long-standing client relationship and maintaining a sustainable business model.

The Scenario

You have a dry cleaning business that has been a loyal client for four years. Their processing has been steady, and their account is currently priced competitively at:

- Basis Points (BP): 0.25%

- Per-Transaction Fee: $0.10

- Your Monthly Residual: Approximately $90

Suddenly, you get a call. The owner is asking for a price reduction, stating that she may switch to a competitor—a new merchant services agent who is the husband of one of her regular dry cleaning customers.

The Competitor’s Promise: He claims he can save her approximately $85 per month.

The Internal Conflict

You instantly run the numbers in your head. With a $90 residual, there is simply no legitimate way for a competitor to provide $85 in savings without either:

- Massively undercutting the already thin margin (leaving almost no residual).

- Misrepresenting the true costs or future fee structures (a common tactic).

The Reality Check: The existing margin is so tight, that any significant reduction would virtually wipe out your residual and the profit on the account.

What Would You Do? (WWYD)

Here’s where the rubber meets the road. Do you prioritize the long-term relationship, or do you stand your ground on the current fair pricing?

- Option A: Counter-Offer and Educate. You know the competitor’s claim is mathematically impossible without sacrificing your profit or hiding future fees. You decide to meet with the client, show her the true cost analysis, and offer a small, symbolic reduction.

- Option B: Stand Your Ground. You politely but firmly explain that the current rate is already a four-year loyalty rate and that the savings promised are unrealistic and likely unsustainable. You wish her well if she chooses to leave.

- Option C: Match the “Savings.” You reluctantly drop the price to the point where your $90 residual is virtually zero (or even negative) just to keep the client, hoping to make it up later or banking on the competitor’s deal falling through.

- Option D: The Delay Tactic. You offer to “look into the rates and see what adjustments can be made” and promise to get back to her. Your hope is that by being agreeable and slow-walking the process, the urgency passes and she forgets about the competitor’s offer.

In this situation, the best approach is to re-engage the client, offer value, and educate her on the reality of the merchant services game.

Steps to Take:

- Acknowledge and Validate: Start by thanking her for her loyalty and for bringing this to your attention. Acknowledge that saving $85 is attractive.“I completely understand why you’d look into that offer. $85 a month is significant, especially for a small business.”

- Request the Proposal: Politely ask her to share the competitor’s written proposal. This is your key to exposing the inevitable hidden costs.“I’m happy to look at your current statement and their new proposal side-by-side. I know your rates are already excellent, and I want to make sure you’re not missing a hidden fee that might pop up later.”

- The Loyalty Offer (Small Reduction): Knowing your $90 residual, you can’t give an $85 reduction. But you can offer a small, tangible concession to show goodwill.

- Reduce the BP to 0.20% and the transaction fee to $0.08. This small tweak retains most of your residual while giving the client a genuine, loyalty-based cut.

- Value Proposition: Reiterate the four years of dependable service, your direct availability, and the lack of surprise fees.

- The Hidden Fee Trap: Focus on the other costs the new agent is likely using to inflate the “savings”:

- Annual Fees/PCI Fees: Are they waived or lowered in your current contract?

- Equipment Leases/Fees: Is the new agent locking her into an expensive lease?

- Interchange Padding: Are they simply hiding the true cost in a tiered or non-clear structure?

Your Takeaway Action

A loyal, long-time client is worth fighting for, but not at the expense of your business. Use this moment to re-establish your value as a transparent partner, not just a rate provider. Show her that the guaranteed, reliable service you provide is worth far more than a likely impossible-to-deliver promise from a brand new agent.

I would like to thank Jim Sauceda for proving this scenario.

So, What do you think? Drop your advice in the comments below!

Happy Selling,

David