You’ve analyzed the statement, built the proposal, and you know you can save them money and upgrade their tech. You’ve got the deal locked down. Then you hear it: the dreaded “NO.”

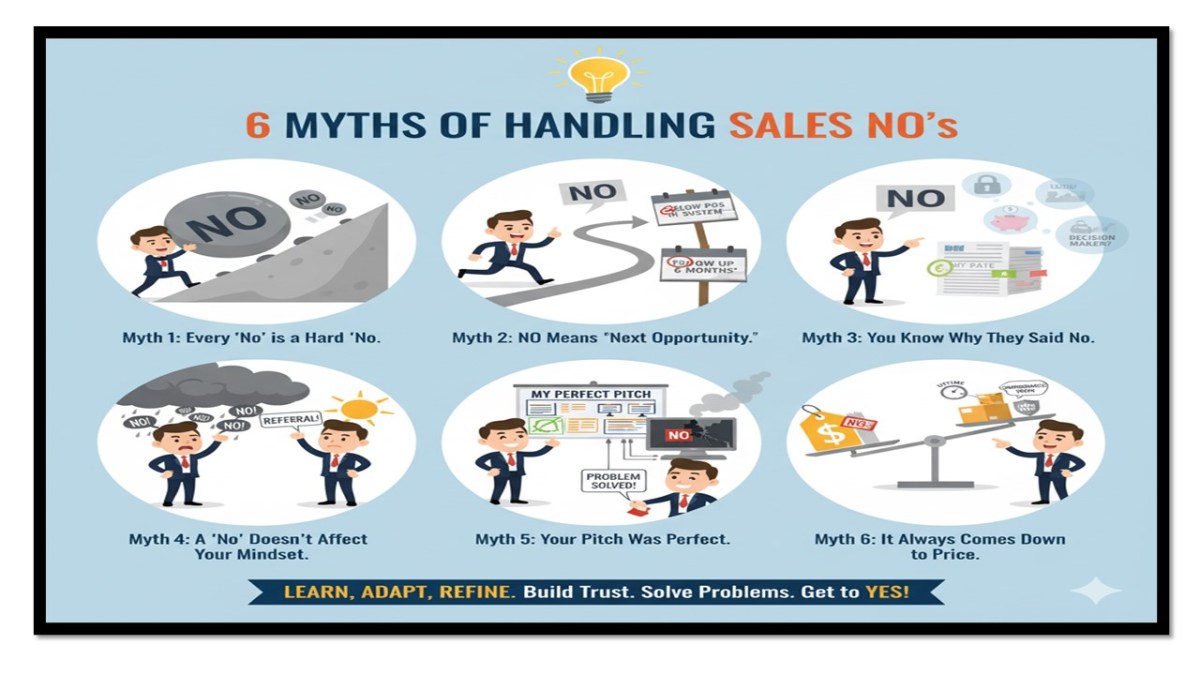

Suddenly, your perfect proposal is dead in the water, and you start questioning your pitch. What do you do? Chalk it up as a loss and walk away, or do you dig in? Here are six common myths about hearing “NO” in merchant services—and how to bust them to close more accounts.

Myth #1: Every “No” is a Hard “No.”

Too many reps treat every “NO” the same. They aren’t. A “NO” from a small coffee shop that does $10,000 a month in volume is different from a “NO” from a multi-location restaurant group. Know which deals are worth fighting for.

More importantly, a “NO” often isn’t about you or your competitor. It’s the merchant choosing to do nothing. Inertia is your biggest competitor. They’re busy, their current system kind of works, and switching sounds like a hassle. Understanding whether you lost to a competitor or lost to inaction is the first step to crafting your next move.

Myth #2: NO Means “Next Opportunity.”

While you can’t waste time on lost causes, moving on too quickly is costing you deals. When a merchant tells you NO, you owe it to yourself—and your pipeline—to ask clarifying questions.

A “NO” is often just a “not right now.” Maybe their current processing contract isn’t up for six months, or they just bought a new POS system. By asking, “Could you tell me a bit more about what led to that decision?” you can uncover the real timeline. Stay engaged, set a follow-up, and turn a delayed decision into a future signed agreement.

Myth #3: You Know Why They Said No.

The biggest trap in this business is assuming you lost on price. Reps default to, “My rate must have been too high,” and move on. Stop assuming.

Did you ever consider:

- They’re locked into a lease on their terminal/POS?

- They have a business loan with the bank that provides their processing?

- The person you spoke to isn’t the real decision-maker?

- They’re worried the transition will disrupt business?

Always verify the “WHY” behind the “NO.” Multiple contacts within the business can give you the real story. Uncovering the true objection is the only way to overcome it.

Myth #4: A “No” Doesn’t Affect Your Mindset.

It absolutely does. Merchant services is a game of numbers and rejection. A string of “NO’s” can crush your confidence, and that energy carries into your next walk-in or call.

When you get a tough rejection, don’t just stew on it. Take immediate action. Call a happy client you recently set up and ask for a referral. Review a signed agreement from a big win. Remind yourself that you provide real value. Reset your mindset before you pitch the next merchant.

Myth #5: Your Pitch Was Perfect.

If you have an ideal merchant profile and they still say NO, don’t blame the merchant. Blame the process. Often, a “NO” comes from a mismatch between your sales cycle and their readiness to buy.

Did you rush to the rate comparison before understanding their operational challenges? Did you talk about saving them $50 a month when their real pain is inventory management or server performance on their outdated POS? Just because they’re a perfect fit doesn’t mean they’re ready for a signature. Create value and solve a business problem first; the rate becomes the easy part.

Myth #6: It Always Comes Down to Price.

This is the biggest myth in payment processing. If a merchant says “NO” because of price, it’s almost never about the rate itself. It’s because you failed to establish value that outweighs the cost.

Shift the conversation from price to cost. What is the cost of their current system’s downtime during a dinner rush? What is the cost of the hours they waste manually entering sales into QuickBooks? What is the cost of a single chargeback they could have won with better tools? When you connect your solution to solving expensive problems, the price becomes an investment, not an expense.

Hearing “NO” is part of the job, but it doesn’t have to be the end of the conversation. Every “no” is an opportunity to learn, adapt, and refine your approach.

- Understand the real objection.

- Ask the right questions.

- Build trust beyond a rate sheet.

- Solve problems, don’t just sell products.

Listen to your merchants, adapt your process to their needs, and you’ll find more of them saying “YES.”

Happy Selling,

David