Here we are again with another Wednesday What Would You do? scenario. As merchant services salespeople, we walk into businesses every day. But some scenarios stick with you more than others. Picture this: you’re in a local auto repair shop. You can smell the faint scent of motor oil and tire rubber, and you’re talking to the owner, a skilled mechanic who’s rightfully proud of the business they’ve built.

You start talking about processing costs and how dual pricing can help put money back in their pocket and that’s when you hear the line we’ve all come to dread, especially in a high-ticket environment like auto repair.

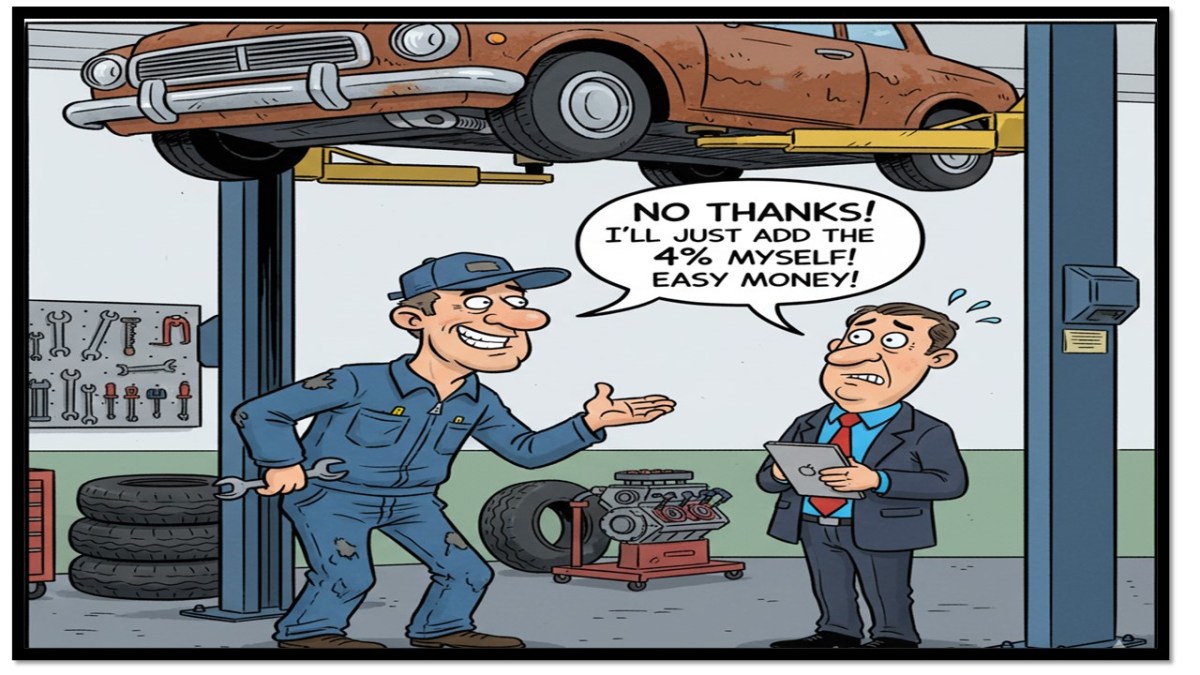

The Scenario: “I Just Add 4% to the Repair Bill!”

You’re talking to the shop owner, and he leans in, thinking he’s sharing a brilliant trade secret.

“Look,” he says, “I’ve got this all figured out. When a customer has a $1,500 bill for a transmission job, I just tell my guy at the counter to add 4% on the terminal if they’re paying with a card. Saves me sixty bucks! If they have cash, I just run it for the original amount. Simple.”

He genuinely believes he’s cracked the code. But we know better. We know this “simple” solution is a ticking time bomb of non-compliance, lost revenue, and major headaches, especially when dealing with large repair orders.

The Flawed Logic: Why He Thinks It Works

From the owner’s point of view, standing there next to a car up on a lift, the math seems not just simple, but profitable. His thought process goes something like this:

- “My actual processing cost is around 2.5%. On this $1,500 repair, that’s $37.50.”

- “But I’ll add a flat 4% ($60) to be safe and cover all the different card types. It’s just easier.”

- “So, I’ll collect $1,560. I pay the processor their $37.50, and I just made an extra $22.50 ($60 – $37.50). This is great!”

He sees it as a smart business move—not just covering his costs, but turning a processing fee into a small profit center. The critical piece he’s missing, however, is that the processor doesn’t care about his math. They see one single transaction, and they take their percentage from the total amount.

This simple misunderstanding is what opens the door to three major problems he can’t see.

Why Their DIY “Solution” is a Problem (And How to Explain It)

Why Their DIY “Solution” is Actually a Problem

- It’s Not a Cash Discount; It’s an Improper Surcharge: After a customer has already agreed to a $1,500 repair, tacking on an extra $60 at the counter feels like a bait-and-switch. A compliant cash discount program is about transparency—displaying the card price so the customer knows what to expect. Manually adding a fee at the last second, especially one that exceeds the actual cost of acceptance, is a non-compliant surcharge that can lead to angry customers, chargebacks, and heavy fines from Visa and Mastercard.

- Analogy: “It’s like giving a customer an estimate for a repair and then adding a ‘shop supplies’ fee at the very end that was never discussed. The process and disclosure are everything.”

- They’re Paying Fees on the Fee! This is the financial gut-punch, and it eats directly into his perceived “profit.”

- Let’s use his $1,500 transmission job.

- Owner’s DIY Method: He adds 4% ($60), charging the customer’s card a total of $1,560. His processing fees (2.5%) are then calculated on the full $1,560. He’s paying $1.50 in fees just on the $60 he collected to cover his costs and generate profit! ($60 x 2.5% = $1.50). That $1.50 comes directly out of the “extra” $22.50 he thought he made.

- Our Solution: With a properly configured cash discount program, the terminal does the math correctly. It ensures the higher card price covers the actual processing cost on the original $1,500 repair, so he keeps his full profit without paying fees on the fee.

- Possible Accounting & Invoicing Nightmares: This is a huge issue for repair shops.

- His invoice may say the job was $1,500.

- His credit card terminal batch report says the transaction was $1,560.

- How does his bookkeeper reconcile that discrepancy every single day? It turns a simple process into a major headache and can even cause issues with how he calculates sales tax on parts and labor.

So, What Would YOU Do?

You’re standing there in the shop, listening to the buzz of an impact wrench in the background. You’ve just listened to the owner proudly explain his system, and you understand his flawed logic perfectly.

This isn’t just a merchant trying to save a few bucks. This is a business owner who believes he’s cleverly created a new, hidden revenue stream by charging 4% on a 2.5% cost. He thinks he’s winning.

How do you pivot him from this mindset? How do you show him that his “smart” business move is actually costing him money and putting his entire ability to accept credit cards at risk, all without making him feel foolish?

Share your best tactics in the comments below!

- How do you open the conversation when you know the merchant thinks they are profiting from this manual fee?

- What’s your best analogy for explaining that the “fee on the fee” is eating directly into the very profit he’s trying to create?

- How do you introduce the serious compliance risks of profiting on a surcharge, especially when he just sees it as “building in a little cushion”?

- What’s your strategy for proving that a compliant program, which only covers his actual costs, is ultimately more profitable and secure than his DIY method?

Let’s learn from each other and help our merchants protect their hard-earned profits the right way!

Happy Selling,

David