Let’s set the stage of this weeks scenario. You’re talking to a veterinary office, and they love the idea of dual pricing. They see the potential savings, they understand the mechanics, but then the inevitable objection surfaces: “I’m scared of losing customers by adding a fee.”

It’s a valid concern, and one you’ll hear frequently in the veterinary space. Pet owners are often emotionally invested in their animal’s well-being, and the thought of anything jeopardizing that relationship, even a small processing fee, can be daunting for the vet. So, how do we, as merchant services sales professionals, gently guide them past this hurdle?

Here’s a scenario and some actionable strategies to help you overcome this common objection:

The Scenario: Dr. Miller runs a successful veterinary practice. She’s interested in cash discounting, as the savings are significant. However, she’s hesitant, expressing genuine fear that her loyal clientele will walk away if they suddenly see a processing fee on their bill.

My Thoughts.

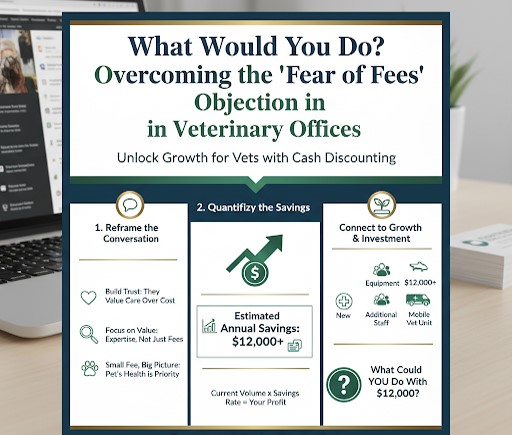

1. Reframe the Conversation: Trust and Value, Not Just Fees

Instead of focusing solely on the fee, shift the narrative to the existing relationship and the value Dr. Miller provides.

- Point out the inherent trust: “Dr. Miller, your customers bring their beloved pets to you because they trust you implicitly with their care. They value your expertise, your compassion, and the well-being of their animals. That trust is paramount, and it’s far more significant than a small processing fee.”

- Emphasize their priorities: “Think about what truly concerns your customers when they bring in their pet. Are they primarily focused on the cost of the office visit, or are they more concerned about getting the right diagnosis, the best treatment, and ensuring their pet is healthy and happy? Most often, it’s the latter.”

- A small fee in the grand scheme: “While a processing fee is new, it’s a very small component in the overall value proposition you offer. Your customers are already invested in their pet’s health, and that investment far outweighs the minor impact of this fee.”

2. Quantify the Savings and Connect to Growth

Numbers speak volumes. Once you’ve reframed the conversation, bring it back to the concrete financial benefits for Dr. Miller’s practice.

- Show the tangible impact: “Dr. Miller, based on your current processing volume, implementing a cash discount program would save your practice approximately [X a per year. This isn’t just a number; it’s money that directly impacts your bottom line.”

- Ask empowering questions: “Now, Dr. Miller, let’s think about what an extra [X amount] on your bottom line could do for your business. Imagine that money was yours to invest back into the practice. What kind of impact could that have?”

- “Could it mean a new, state-of-the-art piece of diagnostic equipment that allows you to offer even better care to your patients?”

- “Would it allow you to hire an additional veterinary technician, improving wait times and freeing up your time for more complex cases?”

- “Perhaps a new vehicle to offer mobile home visits, expanding your reach and convenience for your clients?”

- Build the value in the “WHAT IF”: By connecting the savings to tangible improvements and growth opportunities, you’re building significant value beyond just “saving money.” You’re showing her how this seemingly small change can directly benefit her business and, ultimately, her patients.

3. Address the Implementation & Communication

While not directly about overcoming the initial fear, preemptively addressing how to communicate the change can further alleviate concerns.

- Suggest clear signage: “We can provide clear and professional signage for your reception area and at the point of sale, clearly explaining the cash discount program to your customers.”

- Discuss staff training: “We’ll also work with your staff to ensure they are comfortable and confident in explaining the program to customers, making the transition seamless.”

The “fear of fees” is a natural human reaction, especially when it comes to health care. Your role as a merchant services professional isn’t to dismiss that fear, but to acknowledge it and then skillfully reframe the conversation. By emphasizing the existing trust and value, quantifying the substantial savings, and then connecting those savings to meaningful business growth, you can empower veterinary professionals like Dr. Miller to make a decision that benefits their practice without sacrificing the loyalty of their valued customers. Go out there and build that value!

How would YOU handle this? What would you do? Let me know in the comments below!

Happy Selling,

David